michigan sales tax exemption nonprofit

An exemption from sales. Sales tax exemption is to be used exclusively to make purchases for use by Michigan Technological University and is not for personal use by individuals faculty staff or.

Nonprofits May Need To Collect Sales Tax In These States Givesignup Blog

It is the Purchasers.

. When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing. Nonprofit Organizations with an Exempt letter from the State of. To maintain a 501 c 3 nonprofit corporation in Michigan you must.

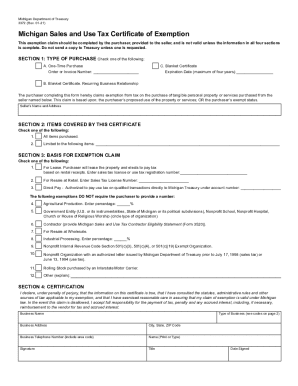

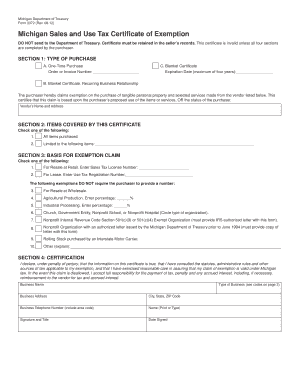

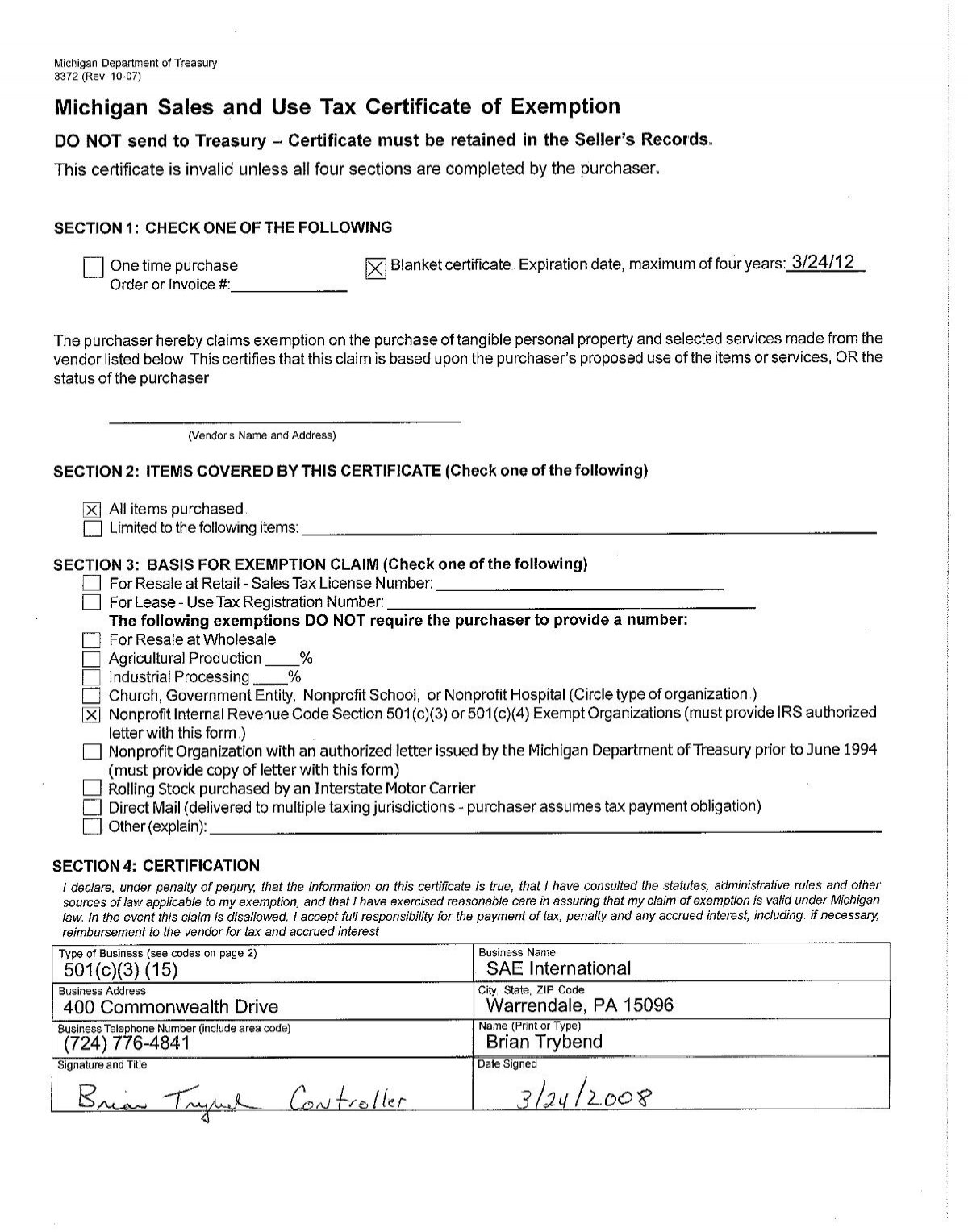

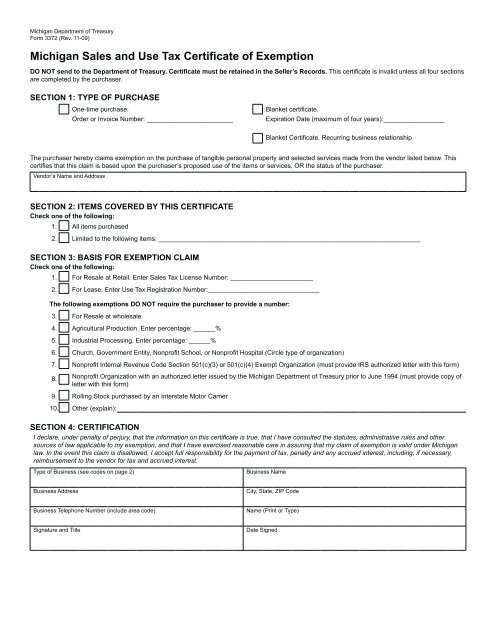

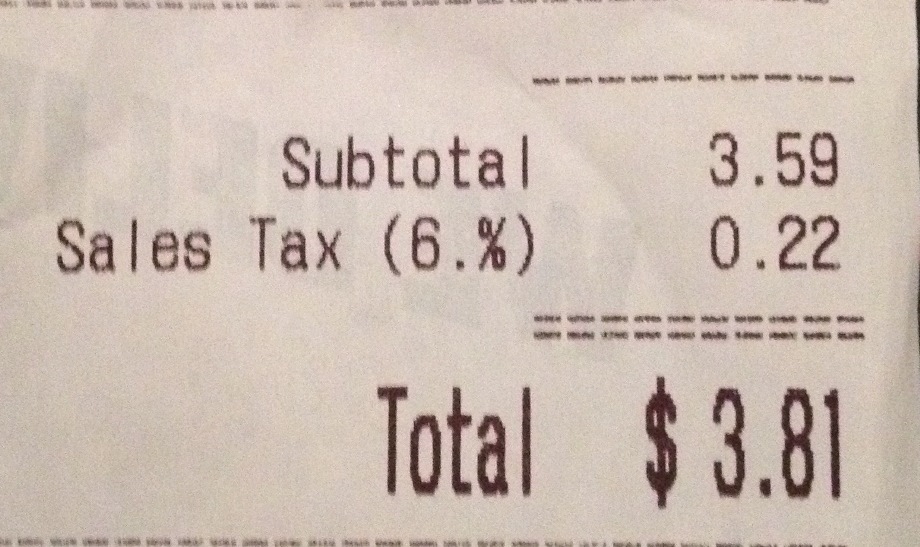

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. DO NOT send to the Department of Treasury.

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. 06 Rental or leasing 15 Non-Profit 501c3 or 501c4 07 Retail 16 Qualified Data Center 08. Nonprofit Internal Revenue Code Section 501c3 and 501c4 Exempt Organizations Attach copy of IRS letter ruling.

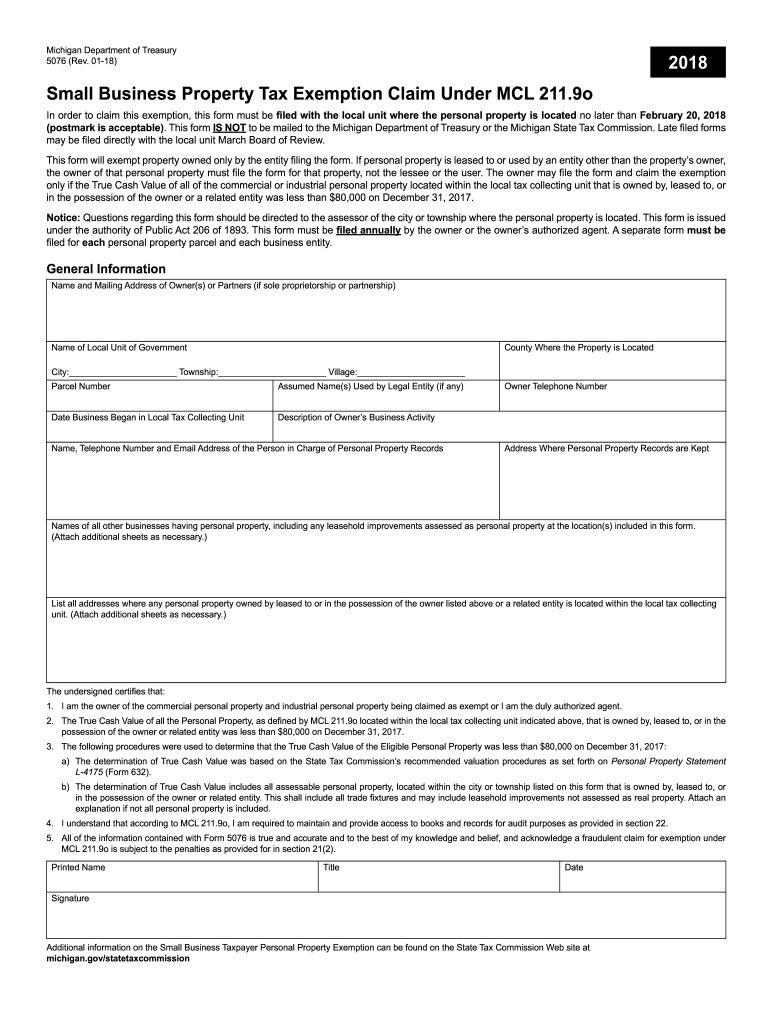

Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS. In order to claim exemption the nonprofit organization must provide the seller with both. 8 Steps to Keep Your Nonprofit Compliant.

Whether your nonprofit operates in one or multiple states obtaining exemptions from income franchise sales and use taxes can consume a great deal of a nonprofits staff time and. Many kinds of transactions are exempt from the sales tax such as sales to nonprofit organizations churches schools farmers and industrial processors. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

The purchase of alcohol does not normally relate to the purpose of an exempt organization so these nonprofit organizations are not exempt from mixed beverage sales tax. This page discusses various sales tax exemptions in Michigan. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax.

Apply for exemption from state taxes.

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan S Tampon Tax Challenged In New Lawsuit Bridge Michigan

Small Business Property Tax Exemption Claim Under Mcl 211 Fill Out Sign Online Dochub

American Legion Department Of Michigan Ppt Download

Mi Dot 3372 2021 2022 Fill Out Tax Template Online

2009 Form Mi Dot 3372 Fill Online Printable Fillable Blank Pdffiller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Nonprofit Sales Tax Exemption Semantic Scholar

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Mi Sales Tax Exemption Form Animart

Does A Nonprofit Need A Lawyer For Irs 990 Forms

Form E 595e Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

If Sales Tax Is Passed Michigan Would Have The Second Highest In The U S Michigan Capitol Confidential

Sales Taxes In The United States Wikipedia

Michigan Sales Tax License Northwest Registered Agent